50+ how much should my mortgage be based on my salary

Web If youd put 10 down on a 333333 home your mortgage would be about 300000. This rule says you.

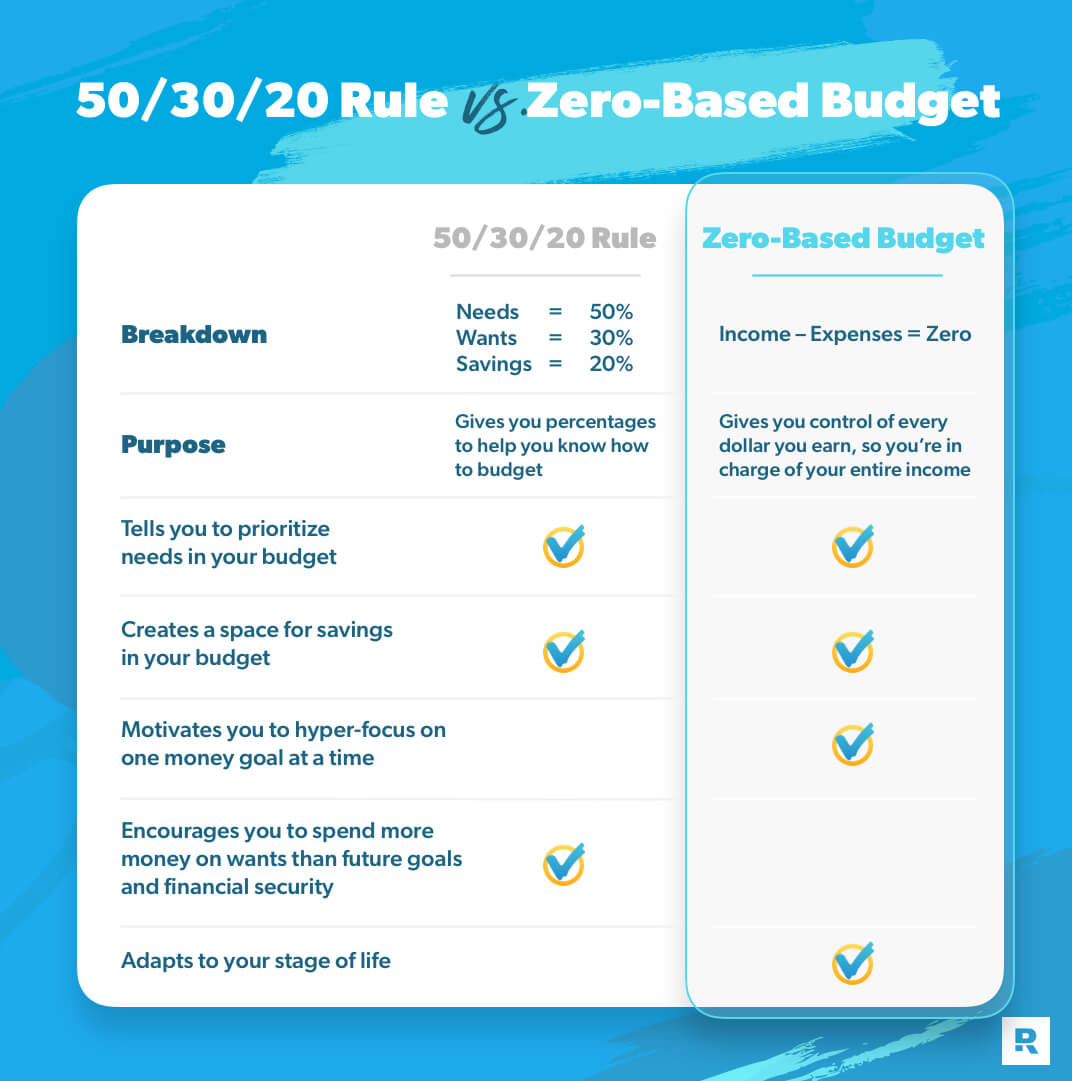

The 50 30 20 Rule Ramsey

Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool.

:max_bytes(150000):strip_icc()/50-30-20budgetingrulecustomillustration-9973713c9be846c1b25b7bf372b4818d.png)

. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web Based on our calculator if you apply for a mortgage with your spouse a lender may grant you a mortgage amount between 211600 to 306600. The 28 rule isnt universal.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web The 3545 Model. Web The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb.

Ad Dedicated to helping retirees maintain their financial well-being. Web Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender. Ad Affordable California Homeowner Insurance.

Lock In Your Low Rate Today. Web 25 Post-Tax Model. See if you qualify.

Web How much of a mortgage can I afford based on my salary. Ad Need To Know How Much You Can Afford. Enter details about your income down payment and monthly debts.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Contact a Loan Specialist. Mark Harris chief executive of mortgage broker.

Well Help You Estimate Your Monthly Payment. Web Below two brokers explain how much you should borrow on your current salary when looking to buy a home. One weeks paycheck is about.

See How Much You Can Save with Low Money Down. Web Your mortgage payment plus all other debt should be no greater than two weeks paycheck. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Thats on the conservative side too. Web Some experts have suggested something called the 2836 rule. Lets say you earn 5000 after taxes.

For example some experts say you should spend no. The 50-20-30 rule is a money management technique that divides your paycheck into three categories. A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your.

Ad Calculate Your FHA Loan Payment Fees More with an FHA Mortgage Lender. To calculate how much you can afford with the. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Low Rates from 8399 Month.

For homes that cost between 500000 and 1000000 the minimum down payment is 5. Some financial experts recommend other percentage models like the 3545 model. Web This model states your total monthly debt should be 25 or less of your post-tax income.

Start By Checking The Requirements. Web For homes that cost up to 500000 the minimum down payment is 5. Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool.

5000 x 028 28 1400. Web Based on the 28 percent and 36 percent models heres a budgeting example assuming the borrower has a monthly income of 5000. Web Use Zillows affordability calculator to estimate a comfortable mortgage amount based on your current budget.

Compare Home Financing Options Online Get Quotes. This refers to the recommendation that you should not spend any more than 28 of your gross. Web A 15-year term.

You can avoid a PMIand reduce your mortgage paymentby saving more for. Ad Calculate and See How Much You Can Afford. Get Your Quote Today.

In that case NerdWallet recommends an annual pretax income of at least 110820. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Find Compare the Best Insurance Quotes Online for Your Home Today.

Connect with a reverse mortgage lender now to see if you qualify with a free consultation. VA Loan Expertise and Personal Service. Note that this not an official.

Web PMI is generally required when your down payment is less than 20 percent of the home value. Are You Eligible For The VA Loan.

50 Free Promissory Note Templates Secured Unsecured

A Guide To Getting A Mortgage If You Re Over 50 Comparethemarket

What To Know About Reverse Mortgages

No 10 Considers 50 Year Mortgages That Could Pass Down Generations Mortgages The Guardian

How Much House Can I Afford Home Affordability Calculator Hsh Com

Livemore Mortgages

How Much House Can I Afford

College Degree After 50 Is It Worth It It Depends Updated Career Pivot

Example Uk Charity Fundraising Budget Template

Economic Impacts Of The Covid 19 Crisis Evidence From Credit And Debt Of Older Adults Journal Of Pension Economics Finance Cambridge Core

The Most Common Multiple Income Streams

Rent To Income Ratio Calculator An Easy Guide For Landlords

How Much House Can You Afford Readynest

50 Finance Resume Examples For 2023 Resume Worded

Mortgages For Over 50s Eligibility Requirements Lending Criteria

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

The 31st District Digest March 22 To March 26 Senator Richard Roth