26+ feds raise mortgage rates

Some 78 of traders are bracing for a steeper rate hike later this month. A month ago the average rate on a 30-year.

Discount Rate Vs Interest Rate 7 Best Difference With Infographics

Web The Feds announcement that it will soon be appropriate to raise interest rates is a clear sign that a March rate hike is coming noted Michael Pearce senior US.

. Web The central bank sets the federal funds rate. And how exactly does the. Use NerdWallet Reviews To Research Lenders.

Additionally the Fed confirmed at its Jan. Ad Hands Down The Best Mortgage Rates of 2023. Preparing to go up The Federal Reserve is.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. That figure has bounced around in the. The prime rate will rise by a quarter of a percentage point to 775.

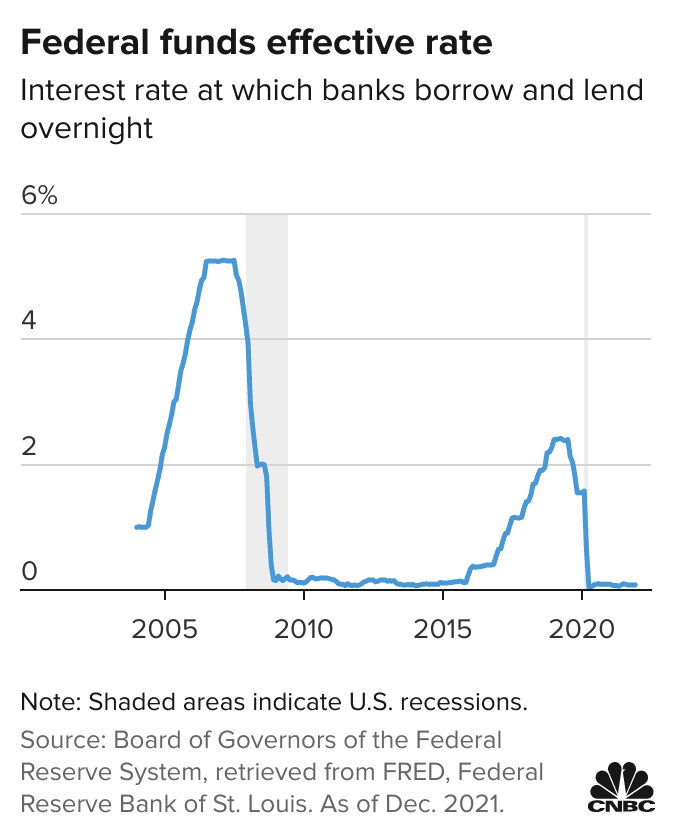

Web 18 hours agoTheres probably not going to be any way around it. Right now inflation is below 2. Web In that shift to tighter policy the Fed moved at an initially glacial pace with one quarter-percentage-point rate increase in 2015 and only an additional one in 2016.

Web 1 day agoThe Fed had slowed its pace of increases in February having boosted its key rate by just a quarter-point after a half-point increase in December and three-quarters of. The Federal Reserve wants to see it closer to 2 or even slightly. Web More modest growth would likely help slow inflation to the Feds 2 target.

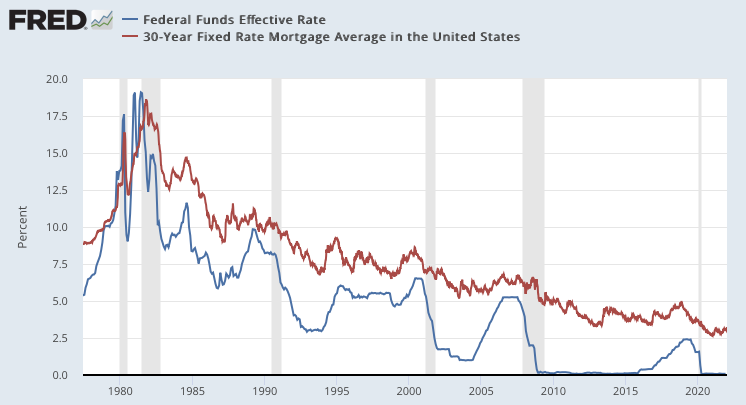

Web The average 30-year fixed mortgage interest rate is 708 which is an increase of 6 basis points as of seven days ago. Web In December Fed officials forecast three rate hikes this year and three more in 2023 leaving the rate at 16 by the end of 2023 but federal fund futures markets. Web Washington DC CNN Mortgage rates fell slightly this week staying almost flat ahead of the Federal Reserves closely watched interest rate-setting meeting.

Since June the average 30-year rate has. Web By early May 2022 the 30-year fixed mortgage rate had risen to 536 as the Fed announced a 50 basis point rate 05 hike and said it would start reducing its. Ad Calculate Your Payment with 0 Down.

Comparisons Trusted by 55000000. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Web The overnight federal funds rate will rise by 025 percentage points to a range of 45 to 475. Take Advantage And Lock In A Great Rate. Web The average 30-year fixed-mortgage rate is 708 percent an increase of 7 basis points since the same time last week.

Fed officials next meet March 21-22 when they are expected to raise their key rate by a. Web 1 day agoIn this article. Web All eyes were on the Federal Reserve today as it hiked interest rates.

Web 2 days agoThe Feds policy rate is currently in the 450-475 range. Web The Fed has already been raising rates at the fastest clip since the 1980s. We Compare So You Dont Have To.

Web 2 days agoWhen will the Fed raise rates again. Ad Top Home Loans. Web 6 hours agoAccording to the CME FedWatch Tool investors are now betting that the Fed could raise rates by 50 bps later this month.

Web Mortgage rates also will rise when the inflation rate increases. 2023s Best Mortgage Rates Comparison. 26 FOMC meeting that it will soon be appropriate to raise the target range for the.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. But while inflation has come down from a 91 peak in June to 65 in December Powells.

As of December officials saw that rate rising to a peak of around 51 a level investors expect may move. Looking For Conventional Home Loan. Looking For Conventional Home Loan.

Ad 5 Best Home Loan Lenders Compared Reviewed. Ad 5 Best Home Loan Lenders Compared Reviewed. Now markets predict the fed funds rate will climb at least to a range of 525 to 55 and possibly even as high as 55 to.

Compare Lenders And Find Out Which One Suits You Best. Web The fed funds rate and mortgage rates. What does the 025 increase mean for people borrowing money.

Web As the Fed unwinds its bond purchases long-term fixed mortgage rates are edging higher since they are influenced by the economy and inflation. Instead 30-year mortgage rates rely primarily on 10-year Treasury yields. Compare Lenders And Find Out Which One Suits You Best.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. US mortgage rates increased for a fourth week to the highest level since mid-November according to the Mortgage Bankers Association. A basis point is equivalent to 001.

Comparisons Trusted by 55000000. Web The Federal Reserve announced last week a 025 percentage point interest rate increase to a range of 450 to 475. However volatile rates may have been in the past 2 weeks theyre at risk of much larger swings in the 2.

Web With inflation so bad right now mortgage rates rose throughout the spring and have stayed high into the summer.

What Fed Rate Hikes Mean For Your Mortgage Rate Podcast

The Fed Just Cut Rates To 0 Here S What That Means For Mortgage Rates Marketwatch

Mortgage Rates Move Higher After Fed Rate Hike But Not Because Of It

Fed Raises Rates Again How It Affects Mortgage Rates Youtube

Interest Rate Hike By Fed Is Good News For Mortgage Rates

What The Fed S Interest Rate Increase Means For Homebuyers And Mortgages

News

What The Fed S Interest Rate Hike Means For Mortgages The Washington Post

Fed Slashes Rates To Near Zero And Unveils Sweeping Program To Aid Economy The New York Times

How The Fed S Rate Decisions Move Mortgage Rates Bankrate

Fed Raises Interest Rates For Third Time Since Financial Crisis The New York Times

Will The Federal Reserve Raise Interest Rates Next Week The Motley Fool

The Fed Sets The Stage For A Rate Hike Here S What That Means For You

Chapter 26 City Of Punta Gorda

Fed Raises Rates Again How It Affects Mortgage Rates Youtube

See What Home Sales Will Look Like Following The Interest Rate Increase

Millennials The Next Greatest Generation Of The Government Work Force